“You guys are changing lives with the advice you give…I owe you all,” says one of the top posts.=

Despite what you may think, Reddit has more than just cat videos.

The popular social news website is home to an abundance of information on personal finance, with one forum being solely dedicated to Canadian personal finance.

The forum, “r/PersonalFinanceCanada,” has been gaining attention since being created four years ago and now boasts almost 24,000 subscribed readers.

According to the bio on the forum, r/PersonalFinanceCanada is a place to discuss anything related to Canadian finance no matter which province you are from.

The forum works by having people post questions about their own finances, such as “30k in TFSA and 60K sitting in the bank, what should I do?” or by posting statements about financing in Canada, such as “TFSA officially $10,000/year.”

Then these posts are opened up to a neighbourhood-like discussion on financing, with the most liked comments being raised to the top of the page.

According to Rob Carrick, a personal finance columnist for the Globe and Mail, the personal finance forum on Reddit is popular because it feels similar to chatting with your friends about finance.

“Millennials don’t feel intimidated to ask the questions they need on Reddit,” says Carrick. “They have real appetite for this sort of thing. It’s definitely growing fast in Canada.”

However, while growing fast, Carrick is quick to note that online forums should always be taken with a grain of salt.

“I’d give this forum a so-so rating for trust,” says Carrick. “I’d definitely bookmark this site, but also some traditional media as well for double checking because sometimes people just get details wrong.”

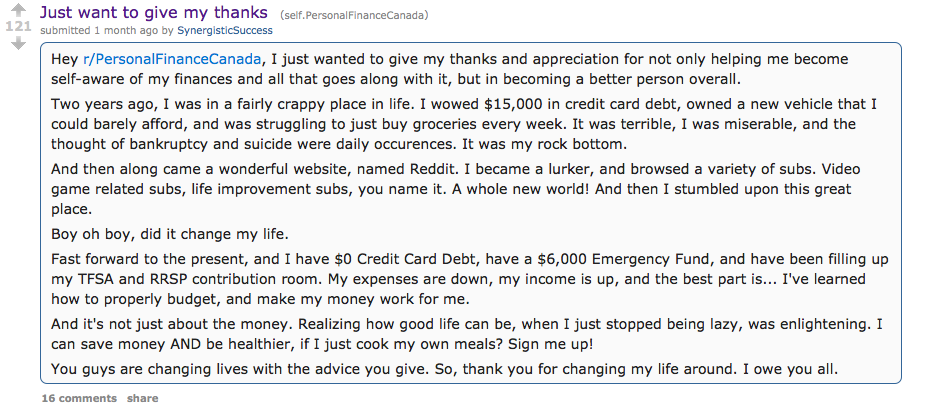

Success stories

While the majority of posts are related to questions or financial tips, occasionally a user shares his or her success story to the online community.

In February, Tyler, a 26-year-old man from Coquitlam, British Columbia reached out to the forum to offer his thanks for their assistance in managing his debt.

“Two years ago, I was in a fairly crappy place in life. I owed $15,000 in credit card debt, owned a new vehicle that I could barely afford, and was struggling to just buy groceries every week. I was miserable,” says the post. “And then along came a wonderful website, named Reddit…. Boy oh boy, did it change my life.”

After being recommended some saving tools and a lot of general advice, such as paying down debts over a specified interest rate, Tyler now has zero credit card debt, $6,000 in an emergency fund, and saving within his TFSA and RRSP.

“It started off with the wealth of information available on the subreddit. From recommending tools, such as Mint or You Need A Budget, to straight up advice,” wrote Tyler in an email.

While other personal finance websites exist already, such as the coverage done by Rob Carrick, Tyler says he thinks Reddit was the most helpful for his learning.

“I have read other sources before, mostly through basic Google searches, but a lot of them give just basic, general tips like pay down debts and save money,” says Tyler. “They don’t really do much to help engage readers or give analysis on specific situations. That’s what really sets r/PersonalFinanceCanada apart from other resources.”